Navigating the Crypto Minefield: A New Investor’s Guide to Avoiding Scams

The cryptocurrency world gleams with the promise of fortune, but lurking in the shadows are sophisticated scams designed to separate you from your hard-earned digital assets. This isn’t a space for the faint of heart, but with the right knowledge and a healthy dose of skepticism, you can navigate the complexities and protect yourself. This guide provides a comprehensive roadmap for new investors, equipping you with the tools to avoid the pitfalls and thrive in this dynamic market.

I. Understanding the Crypto Scam Landscape

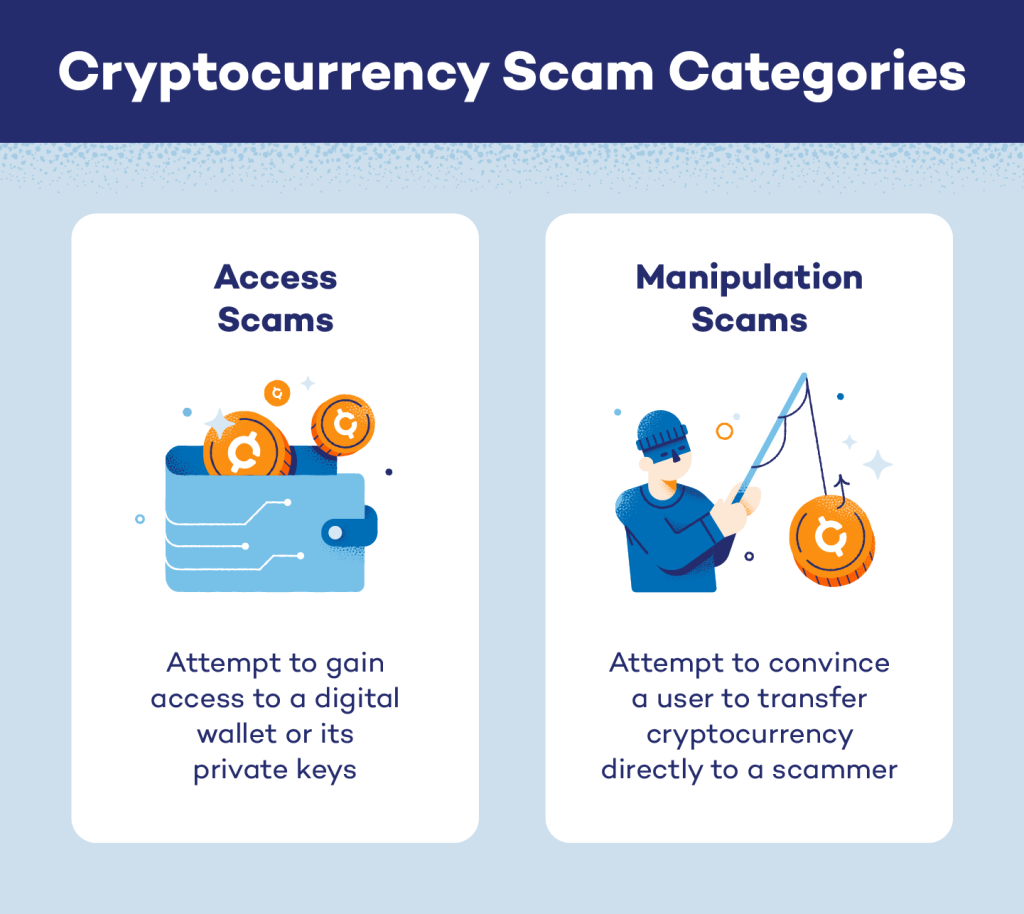

Crypto scams are as diverse as the cryptocurrencies themselves. They range from classic pump-and-dump schemes and fraudulent ICOs (Initial Coin Offerings) to phishing attacks and sophisticated social engineering tactics. Understanding the common types is the first step towards effective prevention.

A. Pump and Dump Schemes: These involve artificially inflating the price of a cryptocurrency through coordinated buying, then selling off large holdings at the peak, leaving unsuspecting investors with worthless assets. The promise of quick riches often masks the inherent risk.

B. Phishing Attacks: These cleverly disguised emails, messages, or websites mimic legitimate platforms, aiming to steal your login credentials, private keys, or seed phrases. Never click on suspicious links or divulge sensitive information unless you’re absolutely certain of the legitimacy of the source.

C. Rug Pulls: These are particularly insidious. Developers create a cryptocurrency, attract investment, and then abruptly disappear with the funds, leaving investors holding worthless tokens. Thorough due diligence is crucial here.

D. Fake ICOs: Many fraudulent ICOs promise unrealistic returns and lack transparency, often disappearing after raising funds. Always research the team, the whitepaper, and the project’s overall viability before investing.

E. Social Engineering: This involves manipulating individuals into revealing sensitive information or taking actions that benefit the scammer. This can involve fake endorsements from celebrities or promises of exclusive investment opportunities.

II. Essential Safeguards: Your Crypto Shield

Protecting yourself requires a multi-layered approach. Think of it as building a robust shield against potential threats.

A. Due Diligence: The Cornerstone of Safety:

Before investing in any cryptocurrency, conduct thorough research. Analyze the project’s whitepaper, assess the team’s credentials, examine the tokenomics (how the token works), and look for community engagement. Beware of projects with overly ambitious claims or those lacking transparency.

B. Verify, Verify, Verify:

Always verify the authenticity of websites, emails, and communication channels. Look for secure HTTPS connections (the padlock symbol in your browser’s address bar) and check for official communication channels on the project’s website.

C. Secure Your Digital Assets:

- Hardware Wallets: These physical devices offer the highest level of security for storing your cryptocurrency.

- Software Wallets: Choose reputable software wallets and enable two-factor authentication (2FA).

- Never Share Your Private Keys: These are your digital keys to your cryptocurrency. Losing them means losing your funds. Treat them like your bank card PIN – never share them with anyone.

D. Beware of Get-Rich-Quick Schemes:

If something sounds too good to be true, it probably is. Legitimate investments carry risk, but unrealistic promises of fast, easy riches are a major red flag.

E. Community Engagement:

Join reputable cryptocurrency communities and forums to engage in discussions and learn from experienced investors. Be cautious of overly enthusiastic individuals promoting unverified projects.

III. Red Flags to Watch Out For

Certain signs consistently indicate potential scams. Learn to recognize these warning signals:

| Red Flag | Description |

|---|---|

| Unrealistic Returns | Promises of guaranteed high returns with minimal risk. |

| Anonymous Teams | Lack of transparency about the project’s developers and team members. |

| Pressure Tactics | Urgent calls to invest before an opportunity disappears. |

| Poorly Designed Website | A website with grammatical errors, broken links, or unprofessional design. |

| Lack of Whitepaper/Roadmap | Absence of a clear plan for the project’s development and future. |

| Unverified Social Media | Social media presence without verification or significant engagement. |

IV. Resources and Further Learning

Staying informed is crucial in the ever-evolving cryptocurrency landscape. Utilize resources such as reputable news outlets, educational platforms, and blockchain explorers to enhance your knowledge and awareness. Remember, continuous learning is key to protecting yourself in this dynamic environment.

V. Conclusion: Embrace Caution, Reap the Rewards

The cryptocurrency space holds immense potential, but navigating it requires vigilance and caution. By implementing the strategies outlined above, you can significantly reduce your risk of becoming a victim of a scam. Remember, knowledge is your greatest asset in this exciting, yet challenging, investment arena. Invest wisely, stay informed, and enjoy the journey.

Additional Information

How to Avoid Scams in the Cryptocurrency Space: Tips for New Investors

The cryptocurrency space, while offering immense potential, is unfortunately rife with scams. New investors, particularly, are vulnerable due to their lack of experience and the often-complex nature of the technology. Avoiding scams requires a multi-pronged approach combining due diligence, critical thinking, and a healthy dose of skepticism.

I. Understanding Common Cryptocurrency Scams:

Before diving into prevention, let’s understand the prevalent scam types:

-

Pump and Dump Schemes: These involve artificially inflating the price of a cryptocurrency through coordinated buying (the “pump”), then selling off large holdings at the inflated price (the “dump”), leaving unsuspecting investors with worthless assets. These are often promoted through social media and Telegram groups.

-

Rug Pulls: Developers of a cryptocurrency project suddenly abandon the project, taking all the invested funds with them. This is often disguised as a legitimate project with a website, whitepaper, and marketing materials. The rug is “pulled” when the developers disappear with the investors’ money.

-

Phishing Scams: These involve fraudulent emails, websites, or messages designed to steal your login credentials, private keys, or seed phrases. They often mimic legitimate cryptocurrency exchanges or projects.

-

Fake ICOs/IEOs: Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) are fundraising mechanisms for cryptocurrency projects. Many fraudulent projects launch fake ICOs/IEOs, promising high returns but delivering nothing.

-

Ponzi Schemes: These schemes pay early investors with money from later investors. They are unsustainable and collapse when new investors stop joining. Cryptocurrency provides a seemingly anonymous environment ideal for such schemes.

-

Fake celebrity endorsements: Scammers use the images and names of celebrities to promote fraudulent cryptocurrency investments, often via fake social media accounts or websites.

-

High-Yield Investment Programs (HYIPs): These promise unrealistically high returns with minimal risk. They are often Ponzi schemes in disguise.

-

Malware and Viruses: Malicious software can steal your cryptocurrency directly from your wallet or compromise your computer to participate in attacks.

II. Strategies to Avoid Cryptocurrency Scams:

-

Thorough Due Diligence: This is crucial. Before investing in any cryptocurrency or project:

- Verify the Project’s Legitimacy: Independently research the project’s team, whitepaper (if available), code (on platforms like GitHub), and community activity. Look for red flags like anonymous developers, unrealistic promises, or a lack of transparency.

- Check for Red Flags: Be wary of projects with vague or overly technical whitepapers, promises of guaranteed high returns, pressure to invest quickly, or lack of verifiable information about the team.

- Scrutinize Social Media: Don’t rely solely on social media hype. Look for credible sources of information and be aware of potential manipulation.

-

Secure Your Assets:

- Use Secure Wallets: Choose reputable hardware wallets (e.g., Ledger, Trezor) or software wallets with strong security features. Never store large amounts of cryptocurrency on exchanges.

- Protect Your Private Keys: Treat your private keys like your bank password – never share them with anyone, and keep them in a secure location. Beware of phishing attempts seeking your keys.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security to your accounts.

-

Be Skeptical of High Returns: If something sounds too good to be true, it probably is. Legitimate cryptocurrency investments carry risk, but unrealistic promises of quick riches should be a major red flag.

-

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different cryptocurrencies to minimize risk.

-

Only Invest What You Can Afford to Lose: Cryptocurrency is a highly volatile market. Only invest money you can afford to lose completely.

-

Stay Updated: The cryptocurrency space is constantly evolving. Stay informed about new scams and security threats through reputable news sources and community forums.

-

Report Scams: If you encounter a scam, report it to the appropriate authorities and platforms.

III. Resources for Further Learning:

- CoinMarketCap: Provides information on various cryptocurrencies.

- CoinGecko: Similar to CoinMarketCap, offering cryptocurrency data and information.

- Blockchain security firms: Many firms specialize in auditing smart contracts and identifying vulnerabilities in cryptocurrency projects.

By applying these strategies, new investors can significantly reduce their risk of becoming victims of cryptocurrency scams and navigate the market more safely. Remember, thorough research, caution, and skepticism are your best allies in the world of cryptocurrency.