How to Safely Store Your Cryptocurrency: A Treasure Map to Wallet Wonderland

The shimmering allure of cryptocurrency – its potential for growth, its decentralized nature – is undeniable. But with great potential comes great responsibility. Securing your digital assets is paramount, a crucial step often overlooked in the excitement of the blockchain boom. This isn’t about locking your fortune in a metaphorical vault; it’s about understanding the diverse landscape of cryptocurrency wallets and choosing the perfect sanctuary for your digital treasures.

Think of your cryptocurrency wallet not as a physical container, but as a sophisticated key – granting you access to your holdings on the blockchain. The type of wallet you choose depends on your tech-savviness, the amount you hold, and your risk tolerance. Let’s embark on a journey through the various wallet types, unraveling their strengths and weaknesses.

1. Hardware Wallets: The Fort Knox of Cryptocurrency

Imagine a physical device, completely offline, safeguarding your private keys. This is the essence of a hardware wallet, the most secure option available. These devices, resembling USB drives, store your cryptographic keys offline, shielding them from malware and online attacks. Leading contenders include Ledger and Trezor, renowned for their robust security features and user-friendly interfaces.

| Feature | Ledger Nano S Plus | Trezor Model One |

|---|---|---|

| Security | Excellent | Excellent |

| User Friendliness | Good | Good |

| Price | Moderate | Moderate |

| Screen | Yes | Yes |

2. Software Wallets: Convenience Meets Caution

Software wallets are digital programs, accessible on your computer, mobile device, or browser. While incredibly convenient, they present a higher risk of security breaches if not handled with care.

-

Desktop Wallets: Offer greater control and security than mobile or browser wallets, but are susceptible to malware if your computer is compromised. Examples include Exodus and Electrum.

-

Mobile Wallets: Portability is their key advantage, but they’re vulnerable to phone theft or malicious apps. Trust Wallet and Coinbase Wallet are popular choices.

-

Web Wallets: Accessed directly through a browser, these offer ease of use but pose the highest security risk due to their exposure to online threats. Consider them for small amounts only, unless using a highly reputable exchange’s integrated wallet.

3. Paper Wallets: The Ancient Scrolls of Crypto

A throwback to simpler times, paper wallets involve printing your public and private keys onto paper. While extremely secure offline, they are susceptible to physical loss or damage. Consider this a last resort or for storing very small, long-term holdings. Generate these using reputable software.

4. Exchange Wallets: Convenient, but Not Your Own

When you buy cryptocurrency on an exchange, it’s stored in their wallet. This offers ease of trading but lacks the control and security of owning your own keys. Exchanges have been hacked in the past, so it’s crucial to only keep the cryptocurrency you need for immediate trading purposes on the exchange.

Choosing Your Crypto Sanctuary: A Personalized Approach

Selecting the right wallet hinges on your individual needs and risk tolerance. For large holdings and long-term storage, hardware wallets are the gold standard. Software wallets are excellent for everyday use and smaller amounts, provided you prioritize robust security practices like strong passwords and anti-malware software. Paper wallets are a niche solution for offline security, while exchange wallets are best suited for active trading.

Beyond the Wallet: A Fortress of Security Practices

No matter the wallet type, these practices will significantly enhance your cryptocurrency security:

- Strong Passwords: Use unique, complex passwords for each wallet and platform.

- Two-Factor Authentication (2FA): Always enable 2FA whenever possible.

- Regular Software Updates: Keep your software and wallets updated with the latest security patches.

- Antivirus Software: Protect your devices with reputable antivirus software.

- Regular Backups: Back up your seed phrases (recovery keys) securely and in multiple locations, ideally offline. Never share your seed phrase with anyone.

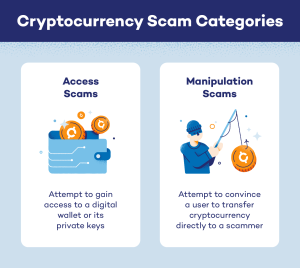

- Be Wary of Phishing Scams: Be cautious of emails, messages, or websites that request your private keys or login details.

Navigating the world of cryptocurrency requires vigilance and careful planning. By understanding the different wallet options and implementing robust security practices, you can safeguard your digital assets and confidently navigate the exciting future of decentralized finance.

Additional Information

How to Safely Store Your Cryptocurrency: Top Wallet Options – A Detailed Analysis

Storing cryptocurrency securely is paramount, as losing access to your funds can be devastating. The best approach often involves diversification across different wallet types, depending on your needs and risk tolerance. Let’s examine the top wallet options, highlighting their strengths, weaknesses, and suitability for different users:

I. Wallet Types:

-

Hardware Wallets: These are physical devices (USB-like) that store your private keys offline. They are considered the most secure option for long-term storage of significant amounts of cryptocurrency.

- Strengths: Extremely secure due to offline nature; resistant to malware, phishing, and online attacks.

- Weaknesses: Can be lost or damaged; relatively expensive; may have limited support for certain cryptocurrencies; require careful handling to avoid physical damage or loss.

- Top Examples: Ledger Nano S Plus, Ledger Nano X, Trezor Model One, Trezor Model T. Note: Research reviews thoroughly before purchasing; counterfeits exist.

- Best For: Long-term storage of large holdings; users prioritizing maximum security.

-

Software Wallets: These are applications installed on your computer, mobile device, or accessed via a web browser. They offer convenience but pose greater security risks.

-

Desktop Wallets:

- Strengths: Generally more secure than web wallets; can support multiple cryptocurrencies.

- Weaknesses: Vulnerable to malware if your computer is compromised; requires careful management of backups.

- Top Examples: Exodus, Electrum (Bitcoin-focused), Atomic Wallet.

- Best For: Users comfortable with managing security software and backups; holding moderate amounts of crypto.

-

Mobile Wallets:

- Strengths: Portable and convenient for everyday transactions.

- Weaknesses: Vulnerable to malware if your phone is compromised; loss or theft of your phone can lead to loss of funds.

- Top Examples: Trust Wallet, Coinbase Wallet, Blockchain.com Wallet.

- Best For: Users who frequently transact with cryptocurrency; those comfortable with mobile security practices.

-

Web Wallets:

- Strengths: Accessible from any device with internet access; convenient for small transactions.

- Weaknesses: Least secure option; highly vulnerable to phishing attacks and website compromises; your private keys are held by the exchange/provider.

- Top Examples: Coinbase, Binance, Kraken (These are exchanges that offer wallet services, not standalone wallets).

- Best For: Small amounts of cryptocurrency; users who prioritize convenience over security. Generally not recommended for long-term or significant holdings.

-

-

Paper Wallets: These involve printing your public and private keys onto paper.

- Strengths: Extremely secure if stored properly; offline and invulnerable to online attacks.

- Weaknesses: Susceptible to physical damage, loss, or theft; difficult to use for transactions; requires meticulous attention to detail during creation and storage.

- Best For: Long-term storage of smaller amounts of cryptocurrency; users who are comfortable with manual processes and can maintain stringent security protocols.

II. Security Best Practices (Applicable to all wallet types):

- Strong Passwords: Use long, complex, and unique passwords for each wallet. Consider using a password manager.

- Two-Factor Authentication (2FA): Enable 2FA whenever possible to add an extra layer of security.

- Regular Software Updates: Keep your software wallets and operating systems up-to-date to patch security vulnerabilities.

- Antivirus Software: Use reputable antivirus software to protect your computer from malware.

- Backup and Recovery: Create backups of your seed phrases (the master key to your wallet) and store them securely offline, separate from your wallet and in multiple locations. Never share your seed phrase with anyone.

- Phishing Awareness: Be vigilant about phishing attempts via email, SMS, or websites. Never click on suspicious links or provide your seed phrase or passwords to anyone.

- Hardware Wallet Security: Handle your hardware wallet with care, protecting it from physical damage. Be wary of counterfeit devices.

- Regular Audits: Periodically review your wallet balances and transactions to detect any unauthorized activity.

III. Choosing the Right Wallet:

The best wallet for you depends on your specific needs and risk tolerance. Consider the following:

- Amount of Cryptocurrency: For large holdings, a hardware wallet is strongly recommended.

- Frequency of Transactions: For frequent transactions, a mobile wallet might be more convenient.

- Technical Expertise: If you’re not tech-savvy, a simpler wallet with good user support might be a better choice.

- Security Priorities: If security is your top priority, a hardware wallet is the safest option.

By understanding the different types of wallets and adhering to robust security practices, you can significantly reduce the risk of losing your cryptocurrency. Remember that no system is perfectly secure, and due diligence is crucial to protecting your assets. Always research thoroughly and choose a wallet that aligns with your individual needs and risk tolerance.